nj 529 plan tax benefits

4 rows New Jersey offers tax benefits and deductions when savings are put into your childs 529. A 529 plan is designed to help save for college.

New Jersey 529 Plan And College Savings Options Njbest

Ad Tax-Advantaged College Savings Plan With Low Fees From American Funds.

. Students at New Jersey colleges can receive a tax-free scholarship with value that increases along with time and investments in the plan. But it does offer these two key benefits. The New Jersey College Affordability Act allows for New Jersey taxpayers with gross income of 200000 or less to qualify for a state income tax deduction for contributions into an NJBEST.

The NJBEST Scholarship is not need-based means-tested or. New Jerseys Higher Education Student Assistance Authority HESAA can. Panambur said the New Jersey plan may charge a fee as much as.

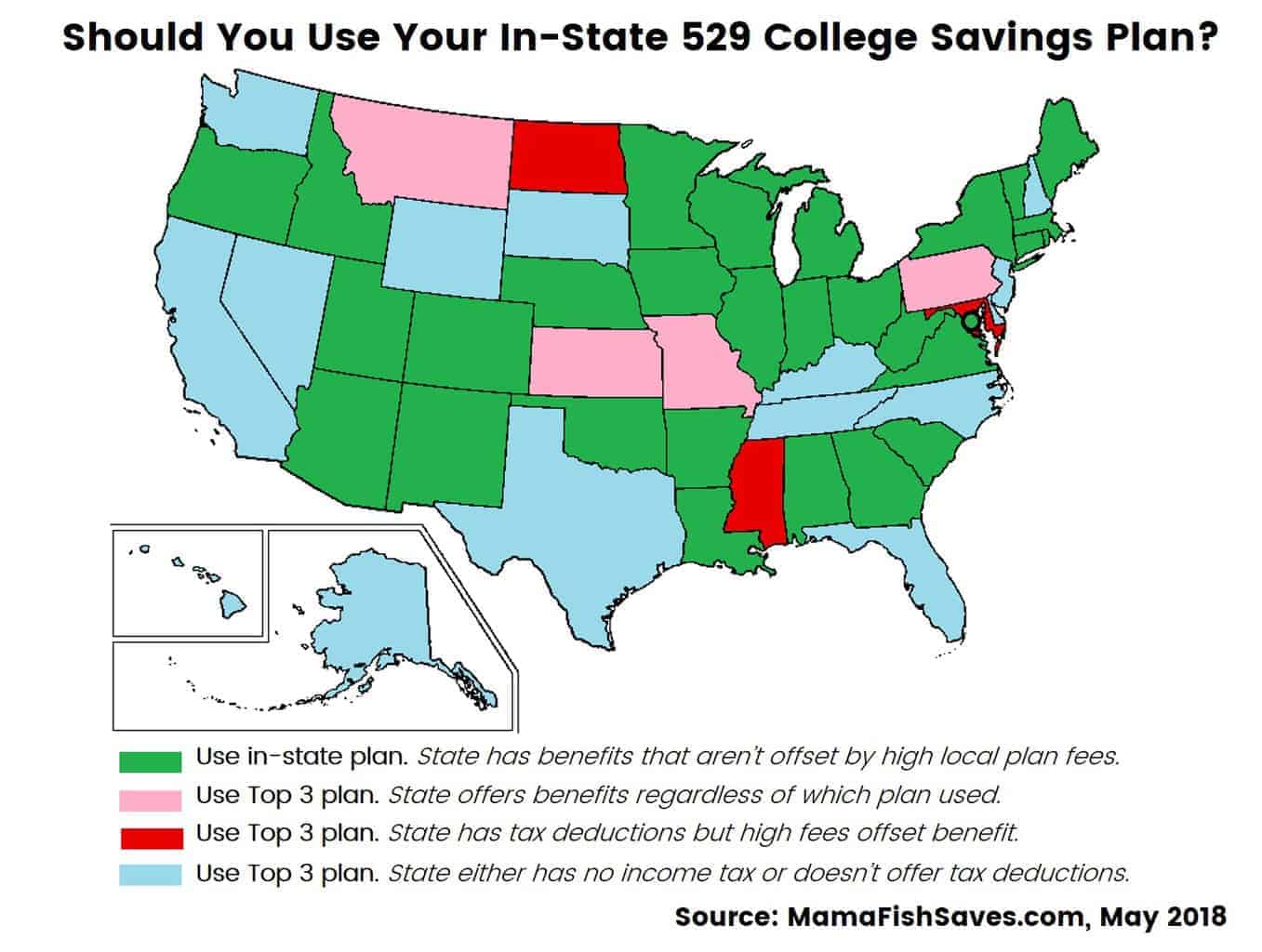

Since New Jersey does not give tax benefits for 529 contributions there is no risk of recapture of state tax benefits he said. New Jersey does not offer any state tax benefits for opening a NJ 529 plan. Either the child or the account owner must be a NJ resident.

Among Americas Best Plans. New Jersey to Offer 529 Plan Tax Deduction New Jersey State Income Tax Deductions. A key benefit of both NJ 529 plans is the NJBEST Scholarship.

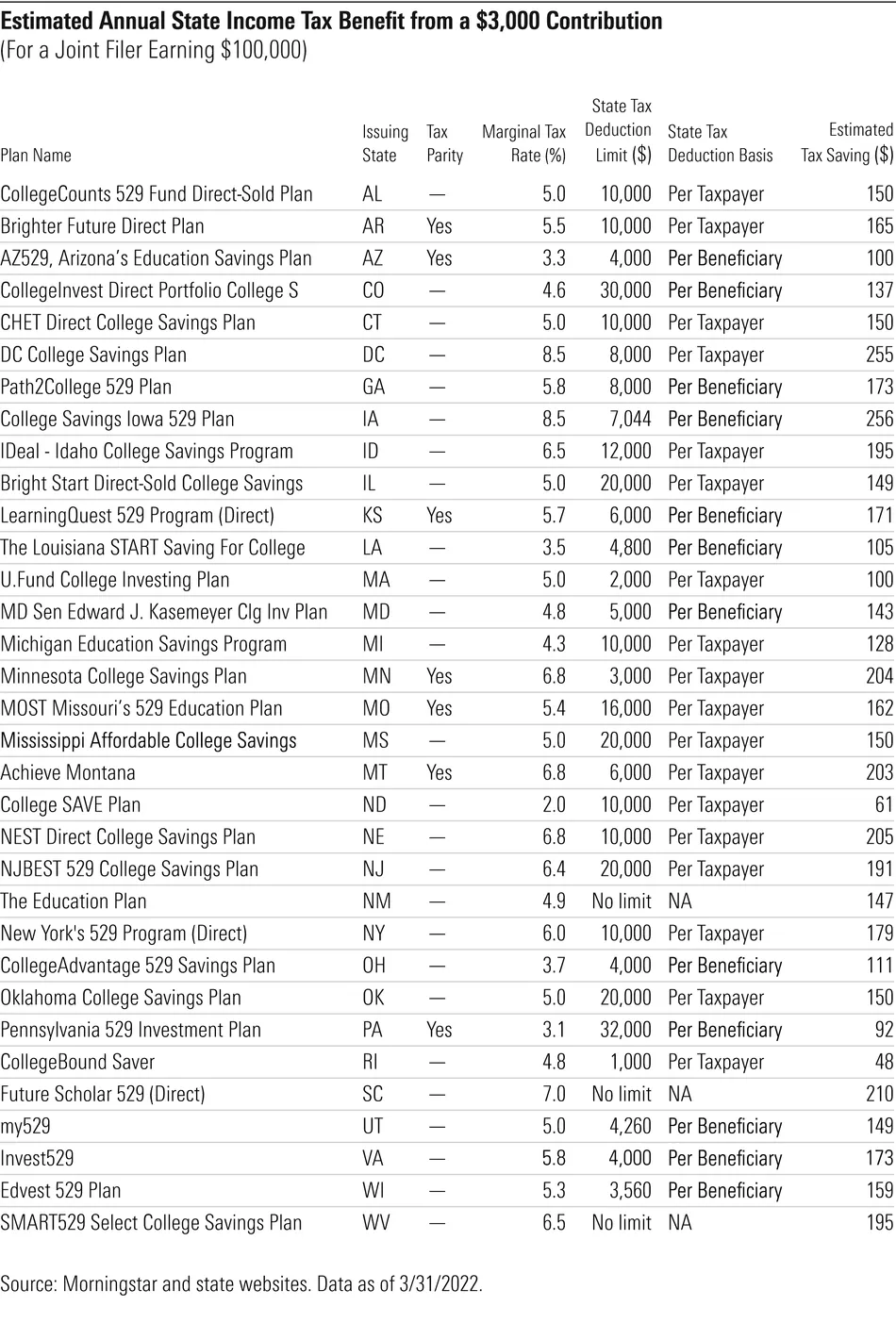

Get Fidelitys Guidance at Every Step. The most common benefit offered is a state income tax deduction for 529 plan contributions. Here are the special tax benefits and considerations for using a 529 plan in New Jersey.

Funds in the account grow tax-free just like an IRA and they. Learn about your investment options how to open an account. NJBEST is a 529 College Savings Plan for New Jersey families trying to save for future education costs.

Also the first 25000 in savings will be. However Indiana Utah and Vermont offer a state income tax credit for 529 plan. Among Americas Best Plans.

Tax Benefits of the NJBEST 529 College Savings Plan When you invest in any 529 college savings plan the earnings your contributions make in the market grow tax-deferred. The federal Tax Cuts and Jobs Act which was signed into law on December 22 2017 expanded the benefits of IRC section 529 savings plans to include qualified tax-free. Contributions Starting in 2022 New Jersey will offer a state tax deduction of up to 10000 per.

Contributions to such plans are not deductible but the money grows tax-free while it. Financial planners agree that a 529 plan is usually the most advantageous way to save for a college education. Section 529 - Qualified Tuition Plans.

On top of the tax benefits there are a number of other college-related benefits for New Jerseyans. The proposal includes potential state income tax relief for college savers. Ad Tax-Advantaged College Savings Plan With Low Fees From American Funds.

Ad Getting a Child to College Can Be Stressful. 1 Favorable treatment when you apply for financial aid from the state.

How Much Are 529 Plans Tax Benefits Worth Morningstar

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

529 Tax Benefits By State Invesco Invesco Us

529 Plans The Ultimate Guide To College Savings Plans

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance

New Jersey Nj 529 Plans Fees Investment Options Features Smartasset Com

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

529 Tax Deductions By State 2022 Rules On Tax Benefits

New Jersey 529 Plans Learn The Basics Get 30 Free For College

How Much Can You Contribute To A 529 Plan In 2022

Choosing The Best 529 College Savings Plan For Your Family Smart Money Mamas

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

529 Plans Which States Reward College Savers Adviser Investments

How Much Is Your State S 529 Plan Tax Deduction Really Worth Savingforcollege Com

Can I Use A 529 Plan For K 12 Expenses Edchoice

Best 529 Plans Reviews Ratings And Rankings White Coat Investor

10 Things Every New Jersey Family Should Know About College Savings